avia-mig.ru

Overview

How To Get A Debt Consolidation Loan With Bad Credit

You could save up to $3, by consolidating $10, of debt · Quick funding · Bad credit · Borrowing experience · Excellent credit · Competitive rates · Good credit. Which option is right for me? It makes sense to discuss your financial situation with someone that can offer professional debt advice and support. Contact. People in the “bad credit” or “low credit score” category are called subprime borrowers and pay a high price for that. If they are approved for a loan with bad. Your lender may reject your application based on your credit report if you have a low credit score due to missed payments, high credit utilization, or accounts. Instant offers: If approved, see personalized loan offers in seconds · Debt payoff: Eliminate high-interest credit card debt · Low payments: Reduce the cost of. Although it may be more difficult to get a debt consolidation loan with bad credit, it is certainly far from impossible. Having a poor credit score does not. Tips for Getting a Debt Consolidation Loan With Bad Credit · Consolidate debts with the highest interest rates. · Get pre-qualified. Lots of lenders let you pre-. The only problem is that most debt consolidation solutions require you to have a good credit score to qualify. If you have bad credit, you either can't qualify. For debt consolidation with lower credit, consider looking into nonprofit credit counseling agencies. They can negotiate lower interest rates. You could save up to $3, by consolidating $10, of debt · Quick funding · Bad credit · Borrowing experience · Excellent credit · Competitive rates · Good credit. Which option is right for me? It makes sense to discuss your financial situation with someone that can offer professional debt advice and support. Contact. People in the “bad credit” or “low credit score” category are called subprime borrowers and pay a high price for that. If they are approved for a loan with bad. Your lender may reject your application based on your credit report if you have a low credit score due to missed payments, high credit utilization, or accounts. Instant offers: If approved, see personalized loan offers in seconds · Debt payoff: Eliminate high-interest credit card debt · Low payments: Reduce the cost of. Although it may be more difficult to get a debt consolidation loan with bad credit, it is certainly far from impossible. Having a poor credit score does not. Tips for Getting a Debt Consolidation Loan With Bad Credit · Consolidate debts with the highest interest rates. · Get pre-qualified. Lots of lenders let you pre-. The only problem is that most debt consolidation solutions require you to have a good credit score to qualify. If you have bad credit, you either can't qualify. For debt consolidation with lower credit, consider looking into nonprofit credit counseling agencies. They can negotiate lower interest rates.

There are primarily three places you can get a debt consolidation loan with bad credit: Banks, credit unions, or online lenders. Visit your local bank or credit. By doing so, their creditworthiness can offset the impact of your bad credit, making it easier to secure the loan. It's important to note that your co-signer. You can get a consolidation loan from banks, credit unions, or alternative lenders. Essentially, you take out a new loan that covers your outstanding bills. You can do this by taking out a second mortgage or a home equity line of credit. Or, you might take out a personal debt consolidation loan from a bank or. Consider getting a secured loan or working with a lender who specializes in debt consolidation loans for low credit. Are there alternatives to a debt. It won't affect your credit score. Apply now Learn more. Home equity loan. Discover fixed rates and payments to help work toward debt. A debt consolidation loan trades one new loan, for your existing loans. If you have bad credit, your interest rate may be high; Depending on your payment terms. A debt consolidation loan combines multiple high-interest debts into one loan, which is repaid at a lower interest rate. Specialized lenders regularly work with them. These lenders perceive more risk when lending to someone with poor credit, so their terms and interest rates are. If you can get your credit score above , you should qualify for a debt consolidation loan enabling you to roll your high-interest credit card debts into a. If your credit score isn't good, you may still be able to get approved by a lender that offers personal loans for fair credit. Borrowers with bad credit should. LightStream: Best for high-dollar loans and longer repayment terms. LightStream · ; Upstart: Best for little credit history. Upstart · Combine balances and make one set monthly payment with a debt consolidation loan Apply when you're ready and get a quick credit decision, typically the same. That's why P2P Credit offers bad credit debt consolidation loans to those who have poor to average credit. Even though you have bad credit, you may still be. Do you have high-interest, unsecured debt from credit cards and personal loans following you around? Consider combining into a single, low-rate debt. You can consolidate your debts by applying for a consolidation loan. Or if a loan isn't right for you, an alternative can be enrolling your credit card debt. 2. Consolidate debt with loans or lines of credit. · Apply for a debt consolidation loan, and then pay just the single monthly payment on your new loan · Open a. Since you have bad credit, expect to pay a higher interest rate on a consolidation loan compared to someone with excellent credit. However, the key is to ensure. Debt consolidation loans are unsecured, meaning the borrower doesn't have to put an asset on the line as collateral to back the loan. However, borrowers will. The credit score you need to qualify for a debt consolidation loan depends on the lender. Depending on the lender, some offer loans to borrowers with credit.

Transfer Money To Credit Card Account

Learn how to transfer funds from bank to credit card avia-mig.ru your customers move their money from a bank to a credit card account in QuickBooks Online. Use mobile or online banking to move money between your accounts and make payments to Navy Federal loans and credit cards. Learn how to transfer funds from bank to credit card account. Move your money from a bank to a credit card account in QuickBooks Online. Read the fine print and note the balance transfer fee. This expense will have to be paid upfront on the amount transferred. The fee is typically around 3% (or. Online banking: Choose Account services, then select Balance transfer from the "Payments" section. U.S. Bank Mobile App: Choose Manage, then select Transfer a. Yes, you can transfer money using a credit card via a cash advance, P2P app, or a money transfer service. But, many of these options come with extra fees, so. To do this, select the Transfer | Send tab, then select Between My Accounts At Bank of America and follow the instructions provided in the Make a Transfer tab. A credit for the amount you transferred will post to your Card Account within hours (you'll see it in the Home tab in the Amex App). The description of. This can be done through various methods such as a bank transfer or using a payment service like PayPal. However, it is important to note that. Learn how to transfer funds from bank to credit card avia-mig.ru your customers move their money from a bank to a credit card account in QuickBooks Online. Use mobile or online banking to move money between your accounts and make payments to Navy Federal loans and credit cards. Learn how to transfer funds from bank to credit card account. Move your money from a bank to a credit card account in QuickBooks Online. Read the fine print and note the balance transfer fee. This expense will have to be paid upfront on the amount transferred. The fee is typically around 3% (or. Online banking: Choose Account services, then select Balance transfer from the "Payments" section. U.S. Bank Mobile App: Choose Manage, then select Transfer a. Yes, you can transfer money using a credit card via a cash advance, P2P app, or a money transfer service. But, many of these options come with extra fees, so. To do this, select the Transfer | Send tab, then select Between My Accounts At Bank of America and follow the instructions provided in the Make a Transfer tab. A credit for the amount you transferred will post to your Card Account within hours (you'll see it in the Home tab in the Amex App). The description of. This can be done through various methods such as a bank transfer or using a payment service like PayPal. However, it is important to note that.

If you're requesting a cash advance from your local bank, they may allow you to visit a bank branch and deposit the funds directly into your bank account. A. There are several ways of transferring cash from your credit card's line of credit over to your bank account. The most common way this is done is called a cash. From the mobile app: · Use your fingerprint to securely log in. · Select Pay & Transfer then Transfer between my accounts. · Select the account you want to. This card allows you to make secure and instant purchases in-store or online using money from your checking account to directly pay for purchases, as well as. Send money with a credit card with Wise. Transfer money in just a few clicks. Over 10 million happy users. Low fees, fast transfers. Save with Wise today. We'll move your money to the bank account associated with the card you selected. Transfer speed will vary depending on the type of transfer you select. Instant. Step 4: Conveniently pay with your bank account, credit card, debit card, or PayPal account. We're here to help. Get human support when you really. Transfer money to a debit or credit 1 card with Western Union, so you can send money for an important occasion, bill payment or as remittance. card immediately takes the money from your connected bank account to pay for purchase. For example, if you have $ in your checking account, and pay for. Whether you're transferring funds using an external card, moving money between your Navy Federal accounts or depositing a check, we've got you covered. Transfer. Looking to transfer money to someone else's bank account or another account you own? Learn how with wire transfers, apps, checks and more. Pay Credit Card Bill · Activate Credit Card. Track your credit score with Select an account and choose “Transfer” or “Transfer Money” at the top of your. It's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. “You'll need to provide your new credit card company with the account numbers of your old cards and tell them how much of your balance you want to transfer,”. You can use e-wallets such as PayTM, Freecharge, MobiKwik, etc. to transfer funds from your credit card account to your bank account. You can transfer money from your Apple Cash card instantly or within 1 to 3 business days. Use a teller. Another way to transfer money from a credit card into a bank account is to use a teller during normal banking hours. You would still need to. This is because the transferred money can be taken out of your current account as cash or used to pay for things with your debit card. Here's an example: You. A money transfer is when you transfer funds from a credit card directly to a bank account for use on purchases. Transfer a balance to your Wells Fargo Credit Card and help your money go further How long would the balance transfer take to post to my credit card account?

Get Cash Out With Credit Card

A cash advance is when you withdraw money against your credit card limit. Essentially, it allows you to withdraw cash like a debit card but with some key. Lottery tickets; Money orders; Off-track wagers; Other wagers; Traveler checks; Wire transfers; Vouchers you can redeem for cash or similar items. Overdraft. Cash advances might allow you to get cash from your credit card at an ATM or bank branch. · Convenience checks might be another option. · Getting cash from a. Unfortunately, this perk doesn't extend to cash advances; interest rates kick in immediately. Watch out for this caveat – you could have accrued quite a bit of. Yes. A customer may get a cash advance from their Regions credit card at any ATM that accepts Visa, at any bank or by calling 1. To withdraw cash from your Credit Card, find an ATM that accepts your card network (Visa, MasterCard, etc.). 2. Insert your Credit Card into the ATM and. A credit card cash advance is a withdrawal of cash from your credit card account. Essentially, you're borrowing against your credit card to put cash in your. You will usually need to go to the teller and present your card and ID. Using this, they will be able to complete the cash advance and get you your cash. 2. Credit card cash advance let you tap into your credit line to get cash when you need it. Learn more to understand the costs & specific conditions. A cash advance is when you withdraw money against your credit card limit. Essentially, it allows you to withdraw cash like a debit card but with some key. Lottery tickets; Money orders; Off-track wagers; Other wagers; Traveler checks; Wire transfers; Vouchers you can redeem for cash or similar items. Overdraft. Cash advances might allow you to get cash from your credit card at an ATM or bank branch. · Convenience checks might be another option. · Getting cash from a. Unfortunately, this perk doesn't extend to cash advances; interest rates kick in immediately. Watch out for this caveat – you could have accrued quite a bit of. Yes. A customer may get a cash advance from their Regions credit card at any ATM that accepts Visa, at any bank or by calling 1. To withdraw cash from your Credit Card, find an ATM that accepts your card network (Visa, MasterCard, etc.). 2. Insert your Credit Card into the ATM and. A credit card cash advance is a withdrawal of cash from your credit card account. Essentially, you're borrowing against your credit card to put cash in your. You will usually need to go to the teller and present your card and ID. Using this, they will be able to complete the cash advance and get you your cash. 2. Credit card cash advance let you tap into your credit line to get cash when you need it. Learn more to understand the costs & specific conditions.

If you do decide to get a cash advance, the most common way is to access the money through an ATM. Simply insert your card, enter your PIN, and select the. When you withdraw cash at an ATM using your credit card, however, the cash is pulled from your credit line instead of your bank account. Explore how to withdraw cash worldwide from MasterCard, Cirrus, or Visa machines. Insight on fees and interest for credit card cash advances provided. When you use your credit card to withdraw cash from an ATM, it is known as credit card cash withdrawal or cash advance. Generally, credit cards are used for. Create the account and link your checking account to receive funds. · Make an invoice with “X” product and send it to yourself. · Use your credit. As long as your ATM or credit card has either a Visa or PLUS logo, you can withdraw cash at ATMs that are part of the Visa or PLUS network. How do I find an ATM. This is known as a cash advance. Cash advances come with hefty fees of up to 5% of the amount you withdraw from your credit card. Additionally, these. A cash advance is when you withdraw money against your credit card limit. Essentially, it allows you to withdraw cash like a debit card but with some key. Is there a limit to how much cash I can get advanced from my credit card? Cash Advance Options · Get cash when you need it with the help of your credit card. · Online Banking · ATM Withdrawal · Bank Branches · Cash Convenience Checks. Generally, the more cash you withdraw with a cash advance, the higher the fees can be. One way to reduce the fees associated with credit card advances is to. Yes! Discover Card provides quick and easy options to get cash anytime and anywhere. You can get cash with your Discover card in three easy ways: (1) cash. - Cash Advance allows Card Members to withdraw cash charged to their Card account at participating ATMs up to the limit on cash advances. Cash Advance Card. Cash advance fee: This is the fee charged every time you withdraw cash using your Credit Card. Typically, it ranges from % to 3% of the transaction amount. As cash transactions can incur more interest and fees than other transactions, credit card providers usually protect you by limiting the amount of cash you can. Next, you'll choose the “cash withdrawal" or “cash advance" option and enter the amount of cash you'd like to receive. Once you've selected your amount and made. You can use a credit card for cash withdrawals, but they come with expensive fees. Here is when they are charged and how to keep your costs down. Credit card cash withdrawals can be done at ATMs of any bank irrespective of the credit card issuing bank. However, a few banks may charge a different cash. Most general purpose credit cards such as MasterCard, Visa and Discover come with a cash advance capability. The cardholder is usually entitled. Ways to get an advance · ATM Withdrawal. Request a PIN number for your credit card by contacting us directly and you can use your credit card to withdraw cash at.

Where Can I Get Free Products

Free Stuff in your area on Facebook Marketplace. Browse or sell your items for free. Free samples are one of life's little pleasures, giving you the chance to try out a makeup product you're interested in without any commitments. M∙A∙C is. We send you FREE avia-mig.ru tell us what you think. BECOME A PINCHer. How PINCHme Works. Get your free samples and exclusive offers in 4 easy steps. Get absolutely FREE makeup, perfume & beauty samples! Request the ones you want and receive them free in the mail. Curious about our iconic formulas or latest launches? Most Clarins products are available in free sample sizes—yours to try every time you place an order. While there are some things on Amazon anyone can get for free right away, the best way to get high-quality freebies is through helpful, informative and well-. Home to thousands of product ratings and reviews. Join the club for access to exclusive product tests – it's completely free. Download the Peekage app to receive and evaluate free product samples. It's simple- you review and we reward. Shipping's on us too! Absolutely FREE Samples! Updated directory of samples & coupons. Pick the ones you want and receive them at home for free. Beauty, food, baby/children. Free Stuff in your area on Facebook Marketplace. Browse or sell your items for free. Free samples are one of life's little pleasures, giving you the chance to try out a makeup product you're interested in without any commitments. M∙A∙C is. We send you FREE avia-mig.ru tell us what you think. BECOME A PINCHer. How PINCHme Works. Get your free samples and exclusive offers in 4 easy steps. Get absolutely FREE makeup, perfume & beauty samples! Request the ones you want and receive them free in the mail. Curious about our iconic formulas or latest launches? Most Clarins products are available in free sample sizes—yours to try every time you place an order. While there are some things on Amazon anyone can get for free right away, the best way to get high-quality freebies is through helpful, informative and well-. Home to thousands of product ratings and reviews. Join the club for access to exclusive product tests – it's completely free. Download the Peekage app to receive and evaluate free product samples. It's simple- you review and we reward. Shipping's on us too! Absolutely FREE Samples! Updated directory of samples & coupons. Pick the ones you want and receive them at home for free. Beauty, food, baby/children.

Add two free samples to your basket. Choose from a variety of deluxe samples, all from your favorite brands. At Package Free, we provide the most sustainable versions of products that you use daily. Our products use zero or minimal packaging and eliminate. Committed to being carbon free by About. Helpful products. Built with you in mind. A group of neatly organized Google products sit on a desktop table. Sign up to get up to $* in offers, including baby formula coupons + free samples. See how to use your coupons and read FAQs. Formerly StrongMoms®. How to get free stuff · 1. Get rewarded for brand loyalty · 2. Scour social media groups · 3. Love your library card · 4. Take a freebie-filled trip · 5. Find. Want to try it. Open to residents of United States. Free product · Schär Discover products by diet. Vegan · Non-GMO · Dairy-Free · Gluten-Free · Social. The Freeya app is the fastest and easiest way to give and get free stuff in your neighborhood. s of FREE SAMPLES, FREEBIES and SAVING TIPS! Updated constantly with all the newest & best Free Stuff, Coupons and Tips to save & make money. Legit Freebies & Samples · Johnson & Johnson Friends & Neighbors · Parent Tested Parent Approved · 9. Moms Meet · 8. Snuggle Bear Den · 7. InStyle. Home Tester Club Home Tester Club is a website where you can test products and share reviews to help shoppers make informed purchasing decisions. The website. We box up products and send them to your doorstep for free. It's like getting a care package from brands you love and other brands you've been waiting to try! Online free samples, freebies and how to get free stuff and products from companies. We also have coupons and promo codes to save you over 50% on purchases. Discover the latest from avia-mig.ru—from seasonal free gifts with purchase to daily offers, exclusive promotions and more. 48 Companies That Send Free Products to Review – · 1. Amazon Vine · 2. PinchMe · 3. Social Nature · 4. Daily Goodie Box · 5. Home Tester Club · 6. BzzAgent. Influenster: Free products. For everyone. Love a freebie? You're in the right place. Influenster partners with top brands to send you their latest products. If you're not going through manufacturers directly, some services offer free products from various companies. One of the most well-known programs of this. Free Stuff Times is the most updated Free stuff site on the internet! Freebies are posted all day long, including samples, stickers, coupons, shirts. Crestline is happy to provide you with up to $10 in promotional product samples. Give us a try today! Earn $5 for Every 5 Surveys You Complete! FREE Month of Audiobooks + 3 FREE Books! FREE Riversol Day Sample Kit! FREE Attends Incontinence Items Sample. All you have to do is ask! The easiest way to ask for free stuff is to send an email directly to the company. You can usually find their email on the “Contact.

Beat Airline Credit Card

/airlines-credit-cards-BAIRCCS0522-ca89294200aa42e7b5cfbf0a9732fdfe.jpg)

VentureOne Rewards for Good Credit · VentureOne Rewards · Venture Rewards · Venture X Rewards · Travel Rewards for Good Credit · 20, Bonus Miles + No Annual Fee. Sign in to see your best offer. Earn MileagePlus award miles through our great selection of United credit card products from Chase. Compare and choose the right perks to improve your travel experience. Find your best fit on Forbes Advisor's list of the best airline credit cards this. Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two ; Top cards for. The Platinum Card® from American Express · Delta SkyMiles® Reserve American Express Card · Capital One Venture X Rewards Credit Card · Capital One Venture Rewards. Airline Credit Cards · Our pick for best welcome offer · Highlights - Chase Sapphire Preferred® Card · Our pick for best unlimited travel rewards card. Choose the best airline credit card for your travel needs to earn bonus miles and points toward free flights, and access other travel benefits. Airline Rewards Cards (4) ; Delta SkyMiles Reserve American Express Card · Earn , Bonus Miles · Delta SkyMiles Reserve American Express Card ; Delta SkyMiles. The best airline credit card overall is the JetBlue Plus Card because it has a reasonable annual fee ($99) and offers a lot of bonus rewards. The card's initial. VentureOne Rewards for Good Credit · VentureOne Rewards · Venture Rewards · Venture X Rewards · Travel Rewards for Good Credit · 20, Bonus Miles + No Annual Fee. Sign in to see your best offer. Earn MileagePlus award miles through our great selection of United credit card products from Chase. Compare and choose the right perks to improve your travel experience. Find your best fit on Forbes Advisor's list of the best airline credit cards this. Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two ; Top cards for. The Platinum Card® from American Express · Delta SkyMiles® Reserve American Express Card · Capital One Venture X Rewards Credit Card · Capital One Venture Rewards. Airline Credit Cards · Our pick for best welcome offer · Highlights - Chase Sapphire Preferred® Card · Our pick for best unlimited travel rewards card. Choose the best airline credit card for your travel needs to earn bonus miles and points toward free flights, and access other travel benefits. Airline Rewards Cards (4) ; Delta SkyMiles Reserve American Express Card · Earn , Bonus Miles · Delta SkyMiles Reserve American Express Card ; Delta SkyMiles. The best airline credit card overall is the JetBlue Plus Card because it has a reasonable annual fee ($99) and offers a lot of bonus rewards. The card's initial.

Sign in to see your best offer. Earn MileagePlus award miles through our great selection of United credit card products from Chase. Travel & Airline Credit Cards · Citi® / AAdvantage® Executive World Elite Mastercard® · Capital One VentureOne Rewards Credit Card · Capital One Venture Rewards. Chase Sapphire Reserve vs. Venture X vs. Amex Platinum. These three travel cards offer similar benefits and rewards, but which is best for you? ; How to maximize. It's one of the fastest ways to collect HawaiianMiles, with no limit on the total miles you can earn. As a new cardmember, you can earn 70, bonus. Chase Sapphire is card is highly regarded for its flexibility and rewards structure. You earn points on a variety of purchases, including 5x. Credit Card Offers · Aeroplan® Credit Card · American Airlines Credit Union Visa® Signature credit · Arvest Visa Signature® Credit Card · Bank of America® Premium. CIBC Aeroplan Business Credit Cards Using a CIBC Aeroplan Business Credit Card is a smart way to grow your Business. Earn points for every eligible dollar. This guide reviews the main types of travel reward credit cards as well as five things to consider when choosing the one (or two or three) for your wallet. A good travel credit card (or a few) is a tool that all financially responsible travelers should be using. However, knowing which travel credit card(s) to apply. Our Travel Rewards Cards · American Express Aeroplan* Reserve Card · American Express Aeroplan* Card · Marriott Bonvoy American Express Card · The Platinum Card. Stack up your miles with these airline credit cards. Find cards with benefits like miles, no foreign transaction fees or checked bags. Chase Sapphire Reserve® is widely regarded as the best premium travel credit card on the market. The annual fee is steep, but the benefits of this card are. Our Bank of America® travel rewards credit cards can get you closer to your next vacation. See more. We've ranked the best credit card offers below with an eye toward those that can help you book luxury travel. Citi / AAdvantage Platinum Select World Elite Mastercard · 2x (Miles per dollar) · % - % (Variable) ; Delta SkyMiles Platinum American Express Card · 1x-. Best travel credit cards of September · + Show Summary · Capital One Venture Rewards Credit Card · Chase Sapphire Preferred® Card · The Platinum. If you're a frequent flyer, you may consider getting an airline credit card. The best options vary based on different factors, and we highlight them all. The Bank of America® Travel Rewards credit card offers unlimited points per $1 spent on all purchases everywhere, every time and no expiration on points. Airline Rewards Cards (4) · Delta SkyMiles Reserve American Express Card · Annual Fee: $ · Annual Fee: $ · Delta SkyMiles Platinum American Express Card. Citi / AAdvantage Platinum Select World Elite Mastercard · 2x (Miles per dollar) · % - % (Variable) ; Delta SkyMiles Platinum American Express Card · 1x-.

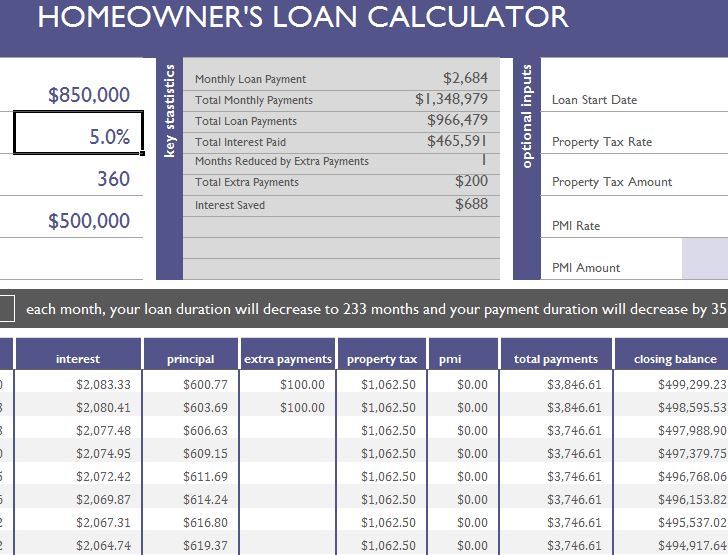

Salary Calculator For House Loan

These home affordability calculator results are based on your debt-to-income ratio (DTI). Industry standards suggest your total debt should be 36% of your. Loan Payment Calculator · Debt Consolidation Calculator · Compare Lines of TDS looks at the gross annual income needed for all debt payments like your house. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. The "principal" is the amount you borrowed and have to pay back (the loan itself), and the interest is the amount the lender charges for lending you the money. Before you compare mortgages with us, use our mortgage calculator to work out how much you could borrow and your estimated monthly repayments. Gross Income (Monthly) in ₹: Input gross monthly income. · Loan Tenure (In Years): Input the desired loan term for which you wish to avail the loan. · Interest. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. mortgage amount, which is the rate applicable to a loan-to-value ratio of % – %. However, the insurance rate for your scenario may be higher or. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. These home affordability calculator results are based on your debt-to-income ratio (DTI). Industry standards suggest your total debt should be 36% of your. Loan Payment Calculator · Debt Consolidation Calculator · Compare Lines of TDS looks at the gross annual income needed for all debt payments like your house. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. The "principal" is the amount you borrowed and have to pay back (the loan itself), and the interest is the amount the lender charges for lending you the money. Before you compare mortgages with us, use our mortgage calculator to work out how much you could borrow and your estimated monthly repayments. Gross Income (Monthly) in ₹: Input gross monthly income. · Loan Tenure (In Years): Input the desired loan term for which you wish to avail the loan. · Interest. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. mortgage amount, which is the rate applicable to a loan-to-value ratio of % – %. However, the insurance rate for your scenario may be higher or. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines.

Mortgage Payment Property Taxes Other Cost Home Insurance. House Price, $, Loan Amount, $, Down Payment, $, Total of Mortgage. Mortgage calculator, buying and renting affordability calculator and debt service (GDS and TDS) calculator. This calculator helps you determine whether or not you can qualify for a home mortgage based on income and expenses. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. loan for primary home priced at $,, with a mortgage balance of $, Lenders will look at your salary when determining how much house you can. Recurring debt payments: Lenders use this information to calculate a debt-to-income ratio, or DTI. A good DTI, including your prospective housing costs, is. Best home improvement loans · Cash advances and overdraft protection. NerdWallet's student loan calculators Payroll & HR · Business taxes · Payment processing. What is your maximum mortgage loan amount? That largely depends on income and current monthly debt payments. This maximum mortgage calculator collects these. Use our calculator to estimate the best loan amount for you based on your current income and commitments. Wondering how much you need to make to qualify for a mortgage? Use our mortgage required income calculator to get an idea of how much mortgage you can. Use NerdWallet's mortgage income calculator to see how much income you need to qualify for a home loan. Once you entered your values, click on “Calculate” to get your Borrowing Capacity. Down payment: 20, $. Maximum mortgage amount: , $. If you want to buy a property, but don't have enough money to pay for it upfront, you can apply to get a mortgage. A mortgage is a loan taken out to buy. Obligations like loan and debt payments or alimony, but not costs like groceries or utilities. Down Payment. Cash. Cash you can pay when you close. Qualifier to Calculate How Much Mortgage I Can Afford on My Salary. Canada Mortgage Qualification Calculator. The first steps in buying a house are ensuring. Use this calculator to better understand how much you can afford to pay for a house and what the monthly payment will be with a VA Home Loan. Note: Calculators display default values. Enter new figures to override. Gross Income. $. /mo. Car Loan. $. /mo. Credit Cards. $. /mo. Student Loan/Other Debts. loan amount you can afford. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. If you have significant. The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want.

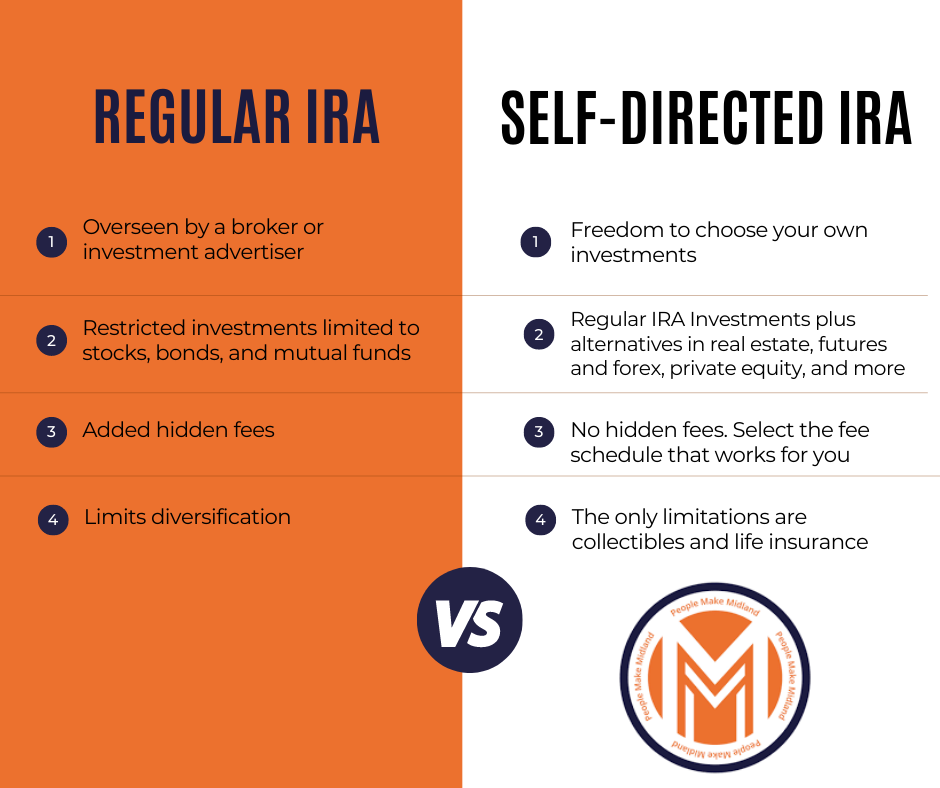

Who Can Set Up A Self Directed Ira

Setting up an IRA LLC can be done in a few simple steps. It involves opening a Self Directed IRA account, establishing an LLC, and opening a checking. A self-directed IRA is just like any other Individual Retirement Account (and can be a traditional, Roth or SEP IRA), but instead of. Per Internal Revenue Service (IRS) rules, SDIRAs must be set up and administered by a trustee or custodian, which can be a bank or other financial institution. A self directed IRA is one in which you can direct your IRA funds into all assets permitted by law. To open an IRA that is truly self-directed, you need to work with a custodian that is qualified to handle this type of account. IRA companies such as Fidelity. For instance, if you have extensive knowledge in the real estate market, you can leverage that experience to make informed decisions in real estate investments. The best self-directed IRA custodian for you will be the one that is easy to understand and serves your specific needs at an affordable price. Start by listing. A traditional IRA has no income limits, but a Roth IRA does. If you make more than $, in gross annual income, there are limits to how much you can. Open a new account online, move savings from another IRA to the account, or make a contribution to the new account. Can a self-directed IRA invest in a business. Setting up an IRA LLC can be done in a few simple steps. It involves opening a Self Directed IRA account, establishing an LLC, and opening a checking. A self-directed IRA is just like any other Individual Retirement Account (and can be a traditional, Roth or SEP IRA), but instead of. Per Internal Revenue Service (IRS) rules, SDIRAs must be set up and administered by a trustee or custodian, which can be a bank or other financial institution. A self directed IRA is one in which you can direct your IRA funds into all assets permitted by law. To open an IRA that is truly self-directed, you need to work with a custodian that is qualified to handle this type of account. IRA companies such as Fidelity. For instance, if you have extensive knowledge in the real estate market, you can leverage that experience to make informed decisions in real estate investments. The best self-directed IRA custodian for you will be the one that is easy to understand and serves your specific needs at an affordable price. Start by listing. A traditional IRA has no income limits, but a Roth IRA does. If you make more than $, in gross annual income, there are limits to how much you can. Open a new account online, move savings from another IRA to the account, or make a contribution to the new account. Can a self-directed IRA invest in a business.

Open a Self-Directed IRA Account. You'll need to appoint a qualified IRA custodian specializing in such accounts. · Fund the Account. Transfers and new. Finance strategists has explained that, anyone who is eligible to open a traditional ira can open a self-directed ira. The rules for prohibited transactions with a self-directed IRA make it nearly impossible for the account holder or his/her family to manage business or real. How to Open an SDIRA · Find a qualified IRA custodian that specializes in SDIRAs. · Determine whether they offer the investments you want. · Set up the account and. Anyone is eligible to open a self-directed IRA who has an existing retirement plan or money saved aside to contribute. Some custodians may require a minimum. It's quick and easy to open a self-directed IRA (SDIRA) at Entrust. The process takes under 10 minutes and there's no minimum balance. It costs $50 to establish. You open an SDIRA with a qualified custodian, which administers the account on your behalf. The custodian can be a bank, trust company or other entity approved. You can set up an LLC thru the SDIRA that way you can write the checks yourself and save a few $$ on transaction fees. This also protects. This flexibility provides you with the ability to invest in what you know. You can leverage your expertise and network to put your IRA to work in your own. You have a whole universe of investment options, and you can think beyond paper securities and hold all kinds of assets. Congress only set a few limits on what. Investor completing an Investment Authorization form to instruct their Self-Directed IRA custodian to invest. Like its standard counterpart, your self-directed. How to Open a Self-Directed IRA · Find a custodian or trustee for the account. · Select the investments you would like to make. · Carry out any due diligence. Yes, Yes, you can establish a new Traditional or Roth self-directed IRA, and can make new contributions according to the contribution limits and rules found in. Fill out the application. Fund your account. Direct your funds. What Should I Look for in a Custodian? While it is not a prohibited transaction for the IRA to make a purchase of the stock of a sub "S" corporation, it is prohibited for the "S" corporation. Simply. You can't open a self-directed IRA with mainstream brokerage firms, like Vanguard or Fidelity. Instead, you must work with a specialty custodian, like Equity. The Self-Directed IRA LLC with “Checkbook Control” has become the most popular vehicle for investors looking to make investments that require a high frequency. A self-directed individual retirement account (SDIRA) is a financial account that allows you to save using traditional assets like stocks and bonds. If you purchase a property with your IRA or other qualified retirement account, can you make updates or rehab the property yourself? No. IRS rules note that. Through this business entity, you as the business owner can set up an investment strategy for your future retirement and promote the success of a newly formed.

Bass Wallet

Genuine leather wallet with an embossed picture of a double bass player. Awesome gift for a jazz music lover. Available additional personalization. Crafted of genuine leather with RFID blocking technology, Al Agnew bass fishing art, 5 card slots, 2 slip pockets and a photo ID window. Handcrafted from premium full-grain leather, it features a meticulously hand-burnished finish that highlights the intricate details of the embossed bass fish. Shop for Weber's Pursuit Bass Duo Fold Leather Wallet for Men at Cabela's, your trusted source for quality outdoor sporting goods. ZEP-PRO is an American manufacturing company of fine leather belts, wallets, and keychains. Our assortment is perfect for the southern man in your life or. Locally made, black leather cowhide wallet. Supporting our local community, these Bass Fisherman enthusiasts' wallets are 4 1/2" L x 2 1/2" W and come with. Design: Bass Material: Real Leather Crazy Horse Color: Brown BiFold. Bifold closure - Are you looking for a unique gift that will really impress? This personalized wallet is a perfect choice! - Each wallet is laser engraved. Check out our bass wallets selection for the very best in unique or custom, handmade pieces from our wallets shops. Genuine leather wallet with an embossed picture of a double bass player. Awesome gift for a jazz music lover. Available additional personalization. Crafted of genuine leather with RFID blocking technology, Al Agnew bass fishing art, 5 card slots, 2 slip pockets and a photo ID window. Handcrafted from premium full-grain leather, it features a meticulously hand-burnished finish that highlights the intricate details of the embossed bass fish. Shop for Weber's Pursuit Bass Duo Fold Leather Wallet for Men at Cabela's, your trusted source for quality outdoor sporting goods. ZEP-PRO is an American manufacturing company of fine leather belts, wallets, and keychains. Our assortment is perfect for the southern man in your life or. Locally made, black leather cowhide wallet. Supporting our local community, these Bass Fisherman enthusiasts' wallets are 4 1/2" L x 2 1/2" W and come with. Design: Bass Material: Real Leather Crazy Horse Color: Brown BiFold. Bifold closure - Are you looking for a unique gift that will really impress? This personalized wallet is a perfect choice! - Each wallet is laser engraved. Check out our bass wallets selection for the very best in unique or custom, handmade pieces from our wallets shops.

This limited edition Bass Bifold Wallet is the perfect gift for any fisherman. Hand-tooled and one-of-a-kind, it features 2 pockets, multiple card slots. Bass Fishing Gifts ➤➤➤Handmade engraved leather wallet "Bass"➤➤➤ Luniko - the best leather goods that are handmade. ➤➤➤ Discounts up to 30%. Bass Fishing Gifts ➤➤➤Handmade engraved leather wallet "Bass"➤➤➤ Luniko - the best leather goods that are handmade. ➤➤➤ Discounts up to 30%. Striped Bass Snap Wallet with keychain clasp and snap closure for convenience on the go. Sustainably made with linen, cork and hemp. Shop Bass Women's Bags - Wallets at up to 70% off! Get the lowest price on your favorite brands at Poshmark. Poshmark makes shopping fun, affordable & easy! Elegance at its best, our Wildlife Bifold Bass Wallet provides a hand-burnished finish, rich full grain leather, and our signature bass concho. The Megabass Field Wallet is a small case for hooks, sinkers, and other small items. It is equipped with 10 zippered bags inside and can hold small lures as. USA Bass Wallet · Expands to Accommodate Both 10 Cards and Bills · Ultra Slim mm Aviation Aluminum Alloy · RFID Wireless Blocking Shell · Built to last. Brown Big Bass Print Rodeo Wallet. Brown Big Bass Print Rodeo Wallet. 0 reviews. $ Excl. tax. or 4 interest-free payments of $ with Sezzle. Looking for mens wallets? We make custom and personalized leather wallets with outdoors and patriotic themes. We have a large variety of wallets in many. Shop for men's wallets at Bass Pro Shops. Find men's bi-fold, tri-fold wallets in leather, camo, and other styles at great prices! Elegance at its best, our Wildlife Bifold Bass Wallet provides a hand-burnished finish, rich full grain leather, and our signature bass concho. DSCjpg. Bass Fish Hook Long Wallet. $ Long Wallet. Color: Select Color, Khaki, Espresso. Khaki Espresso. Quantity: Add To Cart. Long Wallet. Long. Features a gun metal concho for more detail to better match your lifestyle This leather wallet includes a double flip to secure your id and money This. Discover the Handmade Genuine Leather Wallet with a unique double bass print, perfect for jazz lovers and double bass players. Available in card-only or. gh bass wallet brown leather zipper coin section - new ; Est. delivery. Thu, Sep 12 - Sat, Sep From Olney, Maryland, United States ; Returns. Seller does not. Show your passion with an original Zep-Pro burnished leather front pocket wallet featuring a Bass design. The fish imagery on these wallets taps into our. Distressed Leather wallet with embossed animal exterior. Mossy Oak camouflage interior. Choose Deer, Bass or Duck. Inside features 6 credit card slots. Sea Bass Skin Leather Wallet Limited edition Sea Bass skin Leather wallet. Allow weeks for shipping and handling. Reviews. There are no reviews yet. Discover the Handmade Genuine Leather Wallet with a unique double bass print, perfect for jazz lovers and double bass players. Available in card-only or.

Get Paid To Read Books And Write Reviews

Yes, it's possible to earn money by writing reviews for Amazon Kindle books. Some authors or publishers may offer compensation for honest. You'll get paid $$75 per book review. To get started, you can send your resume and a sample review (approximately words) of a recently published book. To earn money by writing book reviews online, start a blog or website, focus on a niche, write high-quality reviews, promote your platform, join. The reviews are expected to be anywhere from words. You will need to submit your resume, writing samples and interests to the email address on their. How to Get Paid to Read Books · 1 Write Book Reviews · 2 Blog About Books · 3 Design eBooks · 4 Narrate Audiobooks · 5 Start a YouTube Channel · 6 Start a Podcast. You're paid for a review once that review is published in the magazine or online. If a review is held for a later issue, that means you might not get paid for. avia-mig.ru lets you choose the titles you'd most like to read from a list of books. You receive the books free and then write a review. Your won't be. Earn While You Read: Top Sites That Pay You for Book Reviews · Discover New Authors and Genres: By reviewing books, you get the chance to explore genres and. How it works: You are given a selection of books to choose. The books are free for you in exchange for a review. After your first approved review. Yes, it's possible to earn money by writing reviews for Amazon Kindle books. Some authors or publishers may offer compensation for honest. You'll get paid $$75 per book review. To get started, you can send your resume and a sample review (approximately words) of a recently published book. To earn money by writing book reviews online, start a blog or website, focus on a niche, write high-quality reviews, promote your platform, join. The reviews are expected to be anywhere from words. You will need to submit your resume, writing samples and interests to the email address on their. How to Get Paid to Read Books · 1 Write Book Reviews · 2 Blog About Books · 3 Design eBooks · 4 Narrate Audiobooks · 5 Start a YouTube Channel · 6 Start a Podcast. You're paid for a review once that review is published in the magazine or online. If a review is held for a later issue, that means you might not get paid for. avia-mig.ru lets you choose the titles you'd most like to read from a list of books. You receive the books free and then write a review. Your won't be. Earn While You Read: Top Sites That Pay You for Book Reviews · Discover New Authors and Genres: By reviewing books, you get the chance to explore genres and. How it works: You are given a selection of books to choose. The books are free for you in exchange for a review. After your first approved review.

Online Book Club · The US Review of Books · Kirkus Media · Booklist Online · Writerful Books · Publishers weekly · Any Subject Books · What is book review. how to become a book reviewer and get paid If you are looking to make money reading and writing book reviews, you are in the right place! Voice is another website where you get paid to read books aloud. Launched in , it helps clients to connect with voice actors for purposes such as book. BookBrowse reviews adult fiction and nonfiction, focusing on enjoyable books with great storylines and characters. Expect to write one review a month of at. Through Online Book Club, you can expect to be paid between $5 and $60, receive the book at zero cost, and then submit your reviews. While you won't be paid for. Start writing book reviews on the books you complete. There are many opportunities to get paid for writing book reviews, one of which is to write reviews. Discover the literacy support software that's helping millions of students across North America to read, write and express themselves independently. Write a review and earn $5 to $60 per book. It seems too good to be true, but it is. ACX is a well-known online network for audiobook voice talent. The platform pays individuals to read books aloud. After you register, you need. 1. Review books Major magazines and newspapers may pay a few hundred dollars for a freelance book review, but if you've never written professionally, you're. Editorial reviews for books under pages are always free, while those for books over pages are paid at a rate of $10 unless we specify a different amount. Join BookTok · Write book reviews as a freelancer · Start a book blog · Run a book club · Proofread books for money · Become a book podcaster · Get paid to narrate. Writerful Books is another fantastic platform where you get paid to read books in English and then write creative reviews on the books you've. There is a list of companies that pay cash for book reviews. As you'll read later, not all companies pay reviewers in this manner. · 1. Kirkus Media · 2. Online. While writing book reviews is a fantastic way to earn cash, it's not the only way for readers to monetize their passion. There are other avenues you can explore. Online Book Club claims to pay and give free books to its book reviewers. You can earn $5 to $60 per review depending upon the book being reviewed. This will be. The US Review of Books; Be an Audiobook Narrator; Work for a Publishing House; Publish Books on Amazon Kindle Direct; Become a getAbstract Freelance Writer. Kirkus reviews is a well-organized site to earn by sharing your book reviews. Kirkus reviews are trusted across popular websites. If you want to participate. how to become a book reviewer and get paid If you are looking to make money reading and writing book reviews, you are in the right place! Kirkus Media is looking for experienced book reviewers of English and Spanish-language titles to review for Kirkus Indie, the book review magazine's section.

Rinsekit After Shark Tank

Shark Tank. Since then, RinseKit has focused exclusively on innovating portable shower technology, taking it to the next level with the launch of the. This is a list of episodes from the eighth season of Shark Tank. Shark Tank. Season 8. No. of episodes, Release. Original network, ABC. RinseKit is a water technology company keeping savvy adventurers clean, in control, and prepared for anything— wherever the workday or weekend takes you. Shark Tank. Wash, Rinse, Sanitize & Shower Anywhere Maximum capacity: Since no space in the water tank is required to. RINSEKIT. 'The Shower' method is one of the most convenient method of washing in the World today. The third representation in the Show was about a Company. RinseKit: Top portable shower from Shark Tank. Clean on the go - shower Since , America's #1 Rack Specialty Store America's #1 Rack Store. Free. Chris Crawford of Carlsbad, California came up with the concept for RinseKit after RinseKit's Kickstarter project also caught the attention of the Shark Tank. Explore · Home Decor. the rinse kit is connected to a water hose. More like this. sharktankshopper · Shark Tank Shopper. followers. RinseKit. RinseKit, the portable pressurized shower, made a $, deal with Daymond John on Shark Tank in Since then they've launched new. Shark Tank. Since then, RinseKit has focused exclusively on innovating portable shower technology, taking it to the next level with the launch of the. This is a list of episodes from the eighth season of Shark Tank. Shark Tank. Season 8. No. of episodes, Release. Original network, ABC. RinseKit is a water technology company keeping savvy adventurers clean, in control, and prepared for anything— wherever the workday or weekend takes you. Shark Tank. Wash, Rinse, Sanitize & Shower Anywhere Maximum capacity: Since no space in the water tank is required to. RINSEKIT. 'The Shower' method is one of the most convenient method of washing in the World today. The third representation in the Show was about a Company. RinseKit: Top portable shower from Shark Tank. Clean on the go - shower Since , America's #1 Rack Specialty Store America's #1 Rack Store. Free. Chris Crawford of Carlsbad, California came up with the concept for RinseKit after RinseKit's Kickstarter project also caught the attention of the Shark Tank. Explore · Home Decor. the rinse kit is connected to a water hose. More like this. sharktankshopper · Shark Tank Shopper. followers. RinseKit. RinseKit, the portable pressurized shower, made a $, deal with Daymond John on Shark Tank in Since then they've launched new.

Southern California-Based RinseKit To Appear on ABC's "Shark Tank" Award winning, portable shower company continues its unprecedented media blitz with. At RinseKit, we know that we were the original portable shower company. Our debut on Shark Tank made people aware of what a portable shower was, and since then. RinseKit. Portable showers keep you and your gear clean on the go. Save up to Shark Tank. Since then, RinseKit has been focused solely on innovating. RinseKit" a portable shower system (YES); "DBest Products" a line of carriers and portable carts (YES); Update on: Tom + Chee (Episode ). , "Episode Learn more about RinseKit Portable Showers, the original portable pressurized showers featured on Shark Tank Getting great use out of it after surfing! An easy to browse directory of the business ideas and products from Shark Tank. There have been over pitches and counting! What has CoatChex been up to since Shark Tank? We've been growing and RinseKit, Robin Lawn Care, Rock Bands, RocketBook, RokBlok, RollinGreens. Browse RinseKit portable van showers, the original portable water sprayers as seen on Shark Tank. Getting great use out of it after surfing! I have. Great Idea that Falls Very Short. Reviewed in the United States on March 25, Honestly, this is a great idea. Saw it originally on shark tank, then when. Find out what happened to Shark Tank's Businesses and Entrepreneurs after Shark Tank. Rinsekit Shark Tank Update. 0 thoughts on “Chirps Chips Shark Tank. Was very skeptical even after seeing it on Shark Tank. Got it yesterday and not only is the pressure impressive for no motor, it retains heat extremely well. How has RinseKit's product line expanded since Shark Tank? RinseKit has diversified its offerings with new models and accessories, catering to a wider range of. RinseKit delivers a pressurized spray for up to three minutes. RinseKit stores the strength of a regular household spigot or sink (with adapter) and can be. RinseKit Portable Showers are BPA-free, so they are safe to drink from and you can use its water for cleaning up after cookouts. There are also no moving parts. Shop and buy Rinse Kit PRO Portable Shower Gal from Shark Tank. Express after a long day of hiking, the Rinse Kit PRO has you covered. Stay. Since , America's #1 Rack Specialty Store America's #1 Rack Store. Free RinseKit: Top portable shower from Shark Tank. Clean on the go - shower. PORTABLE SURF SHOWER Browse RinseKit portable surfing showers, the original portable water sprayers as seen on Shark Tank. Easily shower off after a surf or. Chris Crawford created RinseKit, a Crawford and partner Eric Fagan received 4 Shark Tank offers, and chose Daymond John to be their best bathing buddy. Shark Tank, to becoming a worldwide brand - RinseKit has come a long way since its humble beginnings. Learn about the full story of its invention and about. Eric Fagan and Chris Crawford appeared in Shark Tank Season 8 to seek an investment in their portable pressurized shower system, RinseKit. Chris and Eric's.